Investors under the age of 40 present a huge opportunity to advisors. The next generation represents a larger population than the Baby Boomer clan who came before them. Studies show they are not satisfied with the financial advice they are receiving. To ensure your firm will remain relevant to these young investors, your attention and ability to adapt to their preferences and expectations are crucial.

As aging clients transfer their wealth to the next of kin, firms are struggling to retain those assets. Your clients’ children have a mindset of their own, and that includes freedom to choose a new advisor. Research shows a very small percentage, just 2% to 15%, of clients’ children will retain the financial advisor their parents use.

The statistic is alarming; what you have seen as your usual revenue source is going to change. Advisory firms need to pinpoint a strategy that will balance serving existing clients with another strategy to connect with young investors or face the chance of losing a large portion of assets.

THE MYTH OF THE BROKE MILLENNIAL

Many advisors are shying away from creating formal plans to reach out to the up and coming generation of investors; assuming that the assets will stay within their firm. Other advisors feel that the next generation controls such a small portion of the country’s wealth, so why bother now. These young investors may not have a pocket full of cash to invest with you now, but the transfer of wealth will take place and it will happen quickly.

Advisors must pay close attention – this is your opportunity:

- $23 trillion dollars will transfer from Boomers to their children within eight years**

- 71% of Millennials are investing, but just 21% are connected to a financial advisor **

- Millennial women will earn more than Millennial men**

- Millennials will outpace Baby Boomer earnings by 2018***

- Millennials will have $2.5 trillion in spending power by 2018***

- 74% of Millennials say they influence the purchase decisions of other generations***

THE FUTURE OF YOUR FIRM

Based on the facts, the question you need to ask yourself now is, “Where do you see your firm in five or ten years?” Your business plan will need to keep pace with your projections and reflect new strategies that will maintain and grow your assets that are different from the strategies you have in place to target Boomers.

Current tactics won’t work with the next generation. Your firm needs to evolve with change, rather than expecting up and coming investors to revert to your outdated methods.

DO YOU REALLY KNOW THE NEXT GENERATION?

Sure, you probably know a few young investors; maybe you have met a few of your clients’ children. Many of you have developed some of your own opinions of the group, knowing they are often referred to as self-centered, narcissists, and trophy kids.

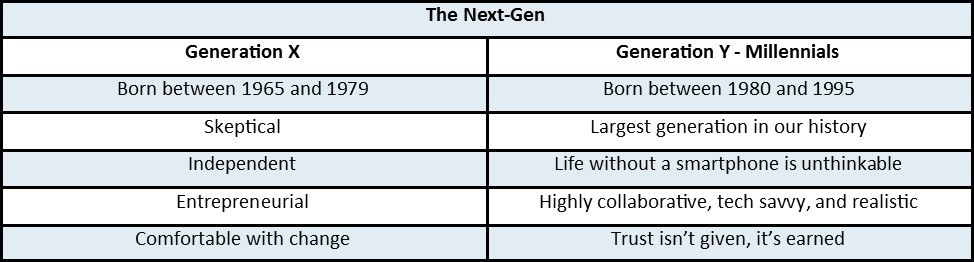

Despite the stereotypes, your firm needs attract them, capture their wealth, and serve them. Here’s a few traits that are good for you to know before developing your strategy.

It is not the strongest or the most intelligent who will survive but those who can best manage change.

– Charles Darwin

THE EVOLVING ROLE OF MARKETING, SALES, AND SERVICE

Engaging with the younger crowd is not an easy thing to do. It will take time and effort on your part and firms that start now stand to outperform firms that don’t. Communication methods will play a key role in grabbing their attention.

Your firm will need to create a communication plan based on methods that the next generation prefers and expects versus methods that are easiest for your firm.

The role of your marketing department has and will continue to be under an enormous amount of pressure to change. Marketing efforts need to evolve from “batch-and-blast” methods to strategies that develop client intimacy and long-term client engagement.

The next generation relies on social media to provide a constant feed of news and advice. They are receptive to infographics and social media posts. Nobody wants a marketing call; this generation will be more than irritated by old-school marketing methods that were once welcomed by their parents.

An annual report by Edelman found that 82% of Millennials say they have more faith in a company that is involved with social media. This generation will not be impressed that you have a website, they expect it. They also expect that their financial advisor be present and active on social media; providing them with advice and guidance as they journey through notable life-stages.

Evolution doesn’t stop with your marketing department. Sales and services teams will need to advance from being information providers to helping clients weed through the vast amount of data they have collected on their own.

6 ACTIONS YOU SHOULD IMPLEMENT NOW

Next-Gen investors like autonomy. They want to have a say in their financial plan, but value the advice of an advisor. Your business model and processes will need to reflect that you understand their unique perspective; they want to retire comfortably, but they place a high degree of importance on living well now.

Unlike the boomers who are engaged by formal communication and printed financial plans, young investors like electronic forms and online meetings. Don’t give a Next-Gen investor a printed brochure. Your “brochure” needs to be available online and communicates precisely what you do and how you add value.

- Provide Immediate and Accessible Information: Next-Gen investors will find the information they are looking for. YOU need to be the one providing it.

- Be Present: Put yourself in front of Next-Gen clients. Create social media profiles and post blogs, videos, podcasts, and other tidbits of helpful information. You can start small with social media, just be sure to do it.

- Master a Variety of Communication Channels: Remember, young investors prefer informal communication. You need to engage with this audience through texting, online meetings, Skype, and smart phone applications. Offer clients an option of meeting choices; online or in-person. They are much more likely to connect with you online first and then in-person once trust is established.

- Expand Service Offerings: Overconfidence and required minimum account balances have stifled advisors from reaching out to Next-Gen investors. Offer a wide range of services and products to meet various investment levels and stages of entry points. Firms will need to provide more for less.

- Become Tech Savvy: To land the assets of the next generation, the future of your firm will depend on your ability to be proactive and provide 24/7 service through online access including mobile devices. The Next-Gen likes DIY (do it yourself) options, but they will look to you for collaboration and validation when making investment decisions.

- Educational Sessions: Reach out to younger investors through their parents. Be available to help with college transition, inheritances, succession planning, and family legacy plans. Advisory firms who start to build relationships now with new investors will help secure the future success of their practice.

By providing value to young investors, they will continue to seek your expertise and advice. Consider adding junior or associate advisors to your team to attract new clients.

Embrace the change. The technology needed to attract future investors is more efficient and will reduce your costs; which in turn boosts your bottom line. You have to place focus on what will sustain the future of your practice.

“Wisdom is knowing what to do next, virtue is doing it.”

– David Starr Jordan

The foundation of our Performance Coaching and Consulting Programs are based on Ironstone’s Fundamental 4™, which is essential to design, develop, and sustain a successful business. Our ultimate goal is to help you avoid trial and error; shifting your mindset to launch your process of intentional change. [LEARN MORE]

Resources

- **Connecting Across the Ages: A Guide to Four Generations of Clients

- ***Edelman Insights 8095 Report. (2012, Dec 3). 8095 refreshed. Retrieved from http://www.slideshare.net/EdelmanInsights -(http://www.slideshare.net/EdelmanInsights/8095-global-external-final)

- Photo credit: ©iStock/Getty Images/Thinkstock